SBI Cashback Credit Card

Table of Contents

How to Get SBI Cashback Credit Card with 5% Savings Online

We all know that Credit card offers many benefits ranging from free credit access to reward points. We regularly publish Lifetime Free Credit Card offers on our blogpost as well as on our Telegram channel. Here we are back with another shopping credit card from SBI card where you can get Flat 5% cashback on online shopping.

The SBI Cashback Credit Card is designed to offer straightforward and rewarding cashback benefits, especially for online shoppers. The best is 5% Cashback on Online Purchases, yes, you can earn 5% cashback on all online transactions without any merchant restrictions & 1% Cashback on Offline Spends, But this card is not Lifetime Free.

SBI Cashback Credit Card Benefits

- You can apply for up to 3 Add-on cards at no additional cost against every primary card

- 5% Cashback on Online spends

- 1% Cashback on Offline Spends

- 1% Fuel Surcharge waiver up to Rs.100 per statement cycle applicable on transactions between ₹500 – ₹3000

Eligibility criteria

- Employment Status: Salaried or Self-employed

- Income: ₹30,000 per month

- Required Age: 21-65 years

- Credit Score: 650+

- New to credit: Only for Salaried

- Credit Card holders are preferred

- No delay payments in last 12 months

- New-to-Credit: Allowed only for salaried applicants

SBI Cashback card charges

As this card gives Flat 5% cashback on online shopping, if you are shopaholic then this is the best card for you even though it has maintenance charges every year, moreover you are getting ₹1000 cashback for applying for this card, hence it is balanced for 1st year, if you don’t utilize it properly for best returns, you will have option to cancel it for next year.

- Joining Charges – ₹999 + GST

- Annual Charges – ₹999 + GST

- Also, Read: HDFC Swiggy credit card with 10% cashback

How to Get SBI Cashback Credit Card with 5% Savings Online

1. First of all Visit the SBI Cashback card offer page from the below button

2. Enter your mobile number and verify it with OTP

3. Now enter your Full Name, Email address and other details asked and continue

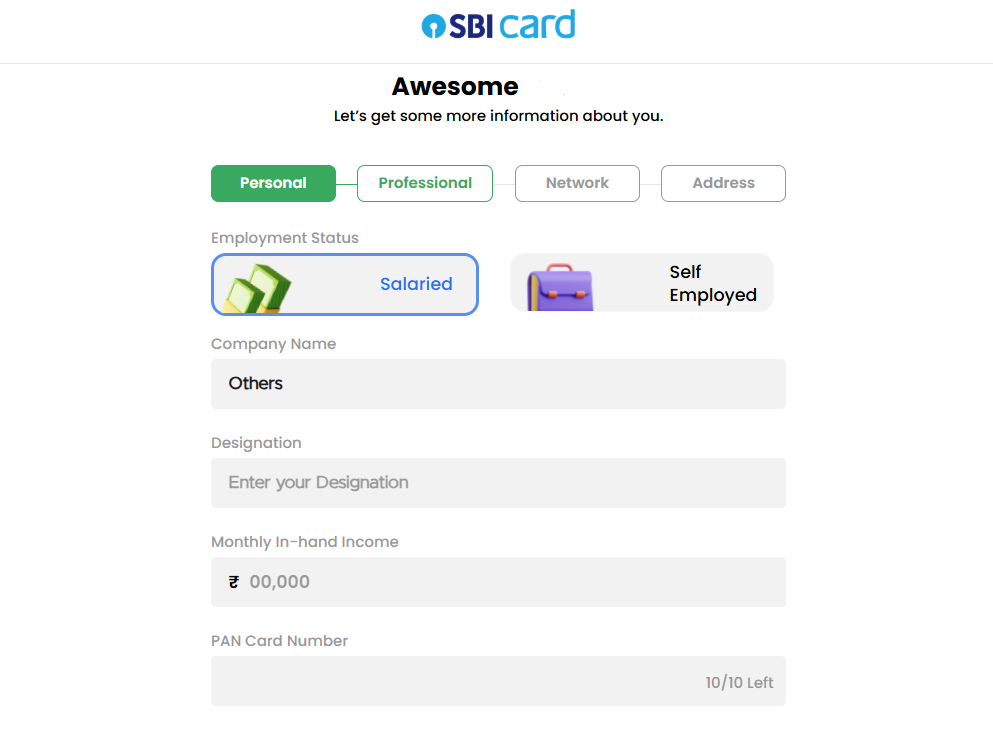

4. Select if you Salaried or self employed and enter PAN Card number & other details asked

5. Now select card variant like Visa or Mastercard

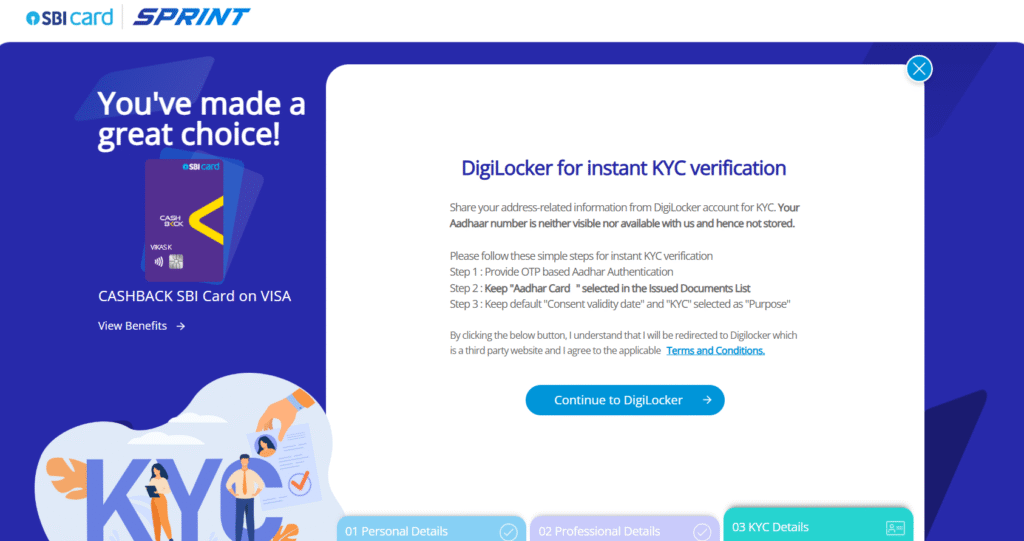

6. Now Continue to DigiLocker for instant KYC verification

7. Enter your Aadhar number and verify it with OTP and give consent to Digi Locker access

8. Now Select your Aadhar address or enter your residential address, card will be delivered to this address.

9. Your application will be complete and wait for the approval from bank

10. Once approved it will be delivered to your doorstep

11. Done !! Enjoy…

Need More Details? If you still have any doubts about this offer or need more information, Just comment below and we’ll surely help you.

Don’t forget to share this article on WhatsApp, Facebook, Instagram, and Twitter

![[OVER] FREE Sample of BYCSS Agarbatti – Free Shipping Free Agarbatti](https://coupontricks.in/wp-content/uploads/2025/01/2-324x160.jpg)