Pay 1/3rd Uni Card Lifetime Free

Table of Contents

How to Get Lifetime Free 1/3rd Uni Card Online with High Credit Score

Uni Card, Uni Card Offers, Uni Card Limit, Uni Card India, Uni Card Benefits, Lifetime Free Uni Card, Uni Card Free – Hello Folks, Hope you guys are enjoying our Lifetime Free Credit Card Offers. We regularly publish new offers and deals on Credit Card and No Cost EMI Credit Limit Apps Like Zest Money. Recently we have posted an amazing Card called OneCard Metal Credit Card with great Offers. Here we are back with another Offer On Lifetime Free Uni Card where you can pay your bills in 3 equal parts in 3 Months without any extra charges

Uni Card is specially designed for young minds searching for a credit limit with the option to pay in 3 parts over 3 months at no extra costs or Pay in 1 month for 1% cashback. This is First of a kind innovation that lets you pay your monthly spending in 3 parts over 3 months without any extra charges. The best part is No joining fee and no annual charges for their early customers.

Benefits of The Pay 1/3rd Uni Card

- Lifetime Free Card. No Joining & No Annual charges

- Free Uni Card Powered by VISA

- Instant Approval on Credit Limit

- Divide your Bills into 3 equal parts for 3 months at no extra costs

- Pay Full Bill on Time and Get 1% Cashback

- Uni Pay 1/3rd Card is accepted at 99.9% of the merchants across the country that accept credit or debit cards.

- Use your credit line to easily scan and pay at your favourite stores.

How to Get Lifetime Free 1/3rd Uni Card Online

1. First of all, Download the Uni Card App on Playstore From The Below Link

2. It will redirect you to the Play Store. Download App

3. Install & Open the App and Click on the Get Started Button

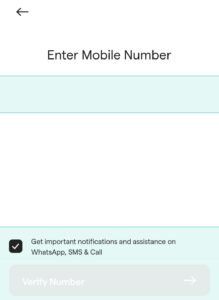

4. Enter your Aadhar Linked Mobile Number and Verify it with OTP

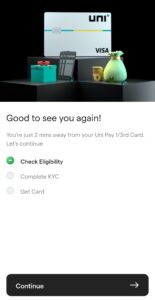

5. Now Tap on the Continue button to Check Eligibility

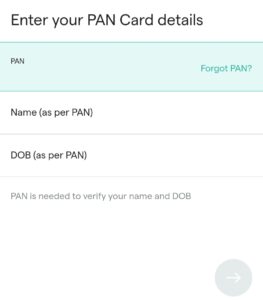

6. Now Enter your PAN Card Number, Name As On PAN Card and Date of Birth & Continue

7. Now Select your Gender, Marital Status & Employment Details and Tap on the Check Eligibility Now Button

8. It will calculate your CIBIL Credit Score and you will get an Instant Credit Limit Between ₹20,000 to ₹1,60,000

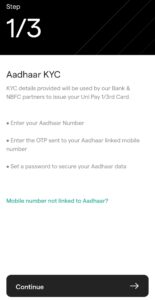

9. Now Tap on The Start KYC Button and Click on continue to complete KYC

10. Now Enter your Aadhar Number, Captcha & Verify it with OTP

11. Set a 4 Digit Password to Secure your Aadhar Data & For Secure Login

12. Now Tap on the Take a Selfie and Snap a Selfie and Upload it

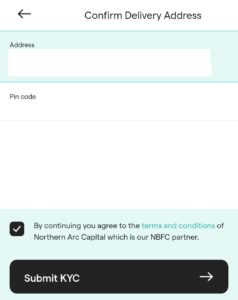

13. Lastly Tap on the Enter Address and Select your Address from CRIF data or enter a new address to get the Card Delivered

14. You are Almost Done !! Just Submit the KYC Details

Note: If your Pin Code is Not Serviceable, then you can Tap on Edit Pincode and Enter your Friend or Relative Pin Code

15. You will get your Credit Limit on the Screen

16. Now Tap On the Get Uni Card Button to Deliver it to your Address

17. You can Start Using your Uni Card Instantly When you receive your Visa Uni Card.

18. You Can Pay Anywhere Online and Offline and Divide your Bill into 3 Equal Parts For 3 Months For No Extra Interest or Charges

For Instance: A Bill Of ₹15,000 is divided into 3 Payments of ₹5000 and Pay the same for the next 3 Months with any extra charges

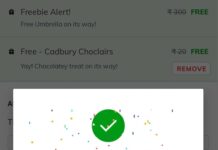

19. Done !! Enjoy…

- You can also check out the Best SBI Credit Cards and Shopping and Rewards

Uni Card Customer Care Contact Details

- Uni Card Whatsapp Support: +91-8867704440

- Uni Card Customer Support Email Address: [email protected]

Need More Details? If you still have any doubts about this offer or need more information, Just comment below and we’ll surely help you.

Don’t forget to share this article on WhatsApp, Facebook, Instagram, and Twitter

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.