IndusInd Bank Savings Account

Table of Contents

Open IndusInd Bank Zero Balance Savings Account and Get up to a 6% Interest Rate

IndusInd Bank Indie Savings Account – Hello Friends, Hope you guys are enjoying our Finance related article and Lifetime Free Credit cards. We recently posted article on how to open Axis ASAP Digital account online. Here we are here with a special article with all the details to open a IndusInd Bank Indie Savings Account where you will get up to 6.75% Interest with premium benefits.

IndusInd Indie is a digital savings account offering up to ₹500/month cashback on bill payments, including credit card bills. It provides 3% cashback on selected brands, 0% forex markup, and lounge access in the Megastar tier. Users enjoy features like numberless debit cards, virtual cards, and UPI integration.

Indie Megastar is a robust digital savings account combining high returns, strong cashback, global usability, premium perks, and smart finance tools. To unlock the full benefit suite, maintain ₹50K quarterly balance or equivalent FD. Let me know if you’d like to dive into tier details, usage strategies, or alternate accounts! Check Comparison at the end.

Benefits of IndusInd Online Savings Account

- Zero-balance account with high interest: Earn up to ~6.75% p.a. on balances, with interest paid quarterly—no minimum balance required

- Up to ₹500/month bill‑pay cashback for Megastar-tier users

- 3% cashback on fuel & select brands

- 0% forex markup + global debit perks

- 1+1 BookMyShow ticket monthly (Visa Signature), and domestic lounge access each quarter

- Auto-sweep to FD (for liquid savings), instant credit line up to ₹5L

- Secure zero-copy technology: Offers dynamic PIN generation, numberless cards, 1-time-use virtual cards, and 4-digit MPIN—enhancing security

- Access to the unique All-In-One store on Indie Mobile App

- Industry-first WhatsApp Banking services

How to Open Indie Savings Account with IndusInd Bank

1. First of All, Install the IndusInd Bank INDIE App on play store from the below button.

2. Open the App and Enter your Mobile number and Validate it with OTP

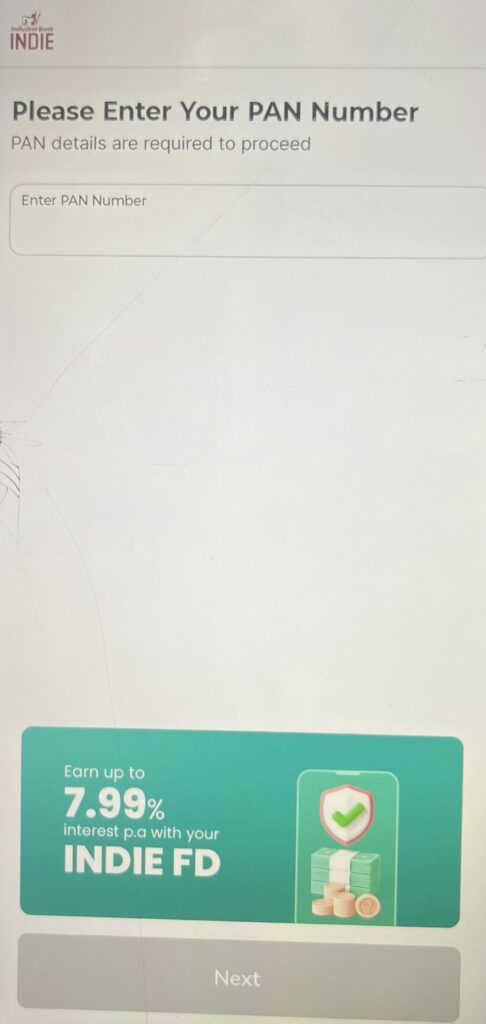

3. Enter your PAN Card number and Click Next

4. Now Enter your Aadhaar card number and Click Next

5. Verify your Aadhaar number with OTP

6. Your details will be fetched from UIDAI database linked to you Aadhaar number

7. Verify the email address and validate the details and Continue

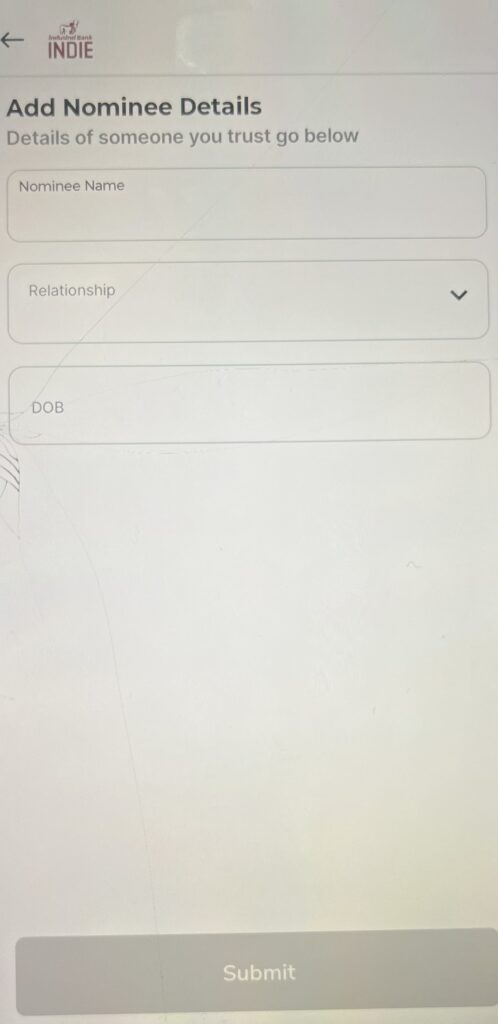

8. Now Add the Nominee details like Nominee Name, relationship and DOB

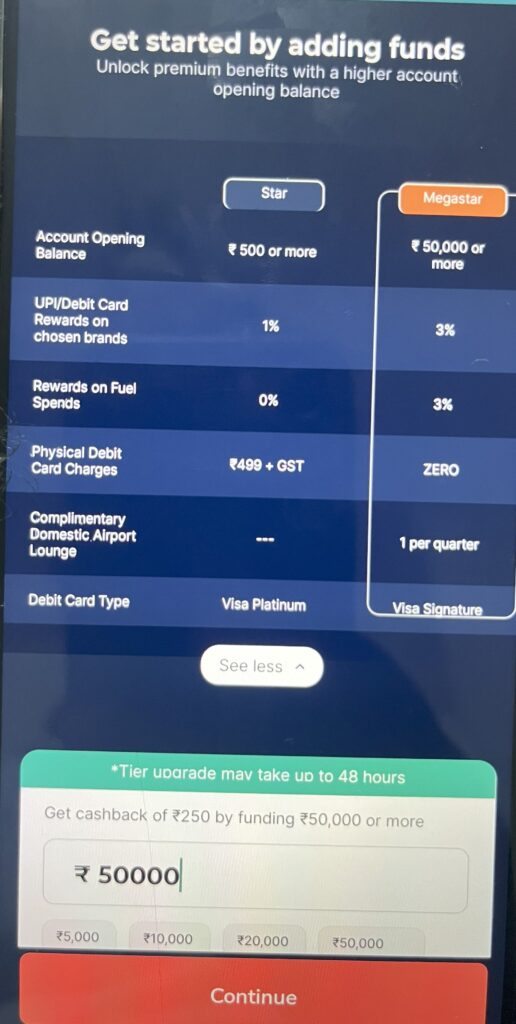

9. Add funds to your account, if you want all the premium benefits, open Megastar account.

Note – You have to Deposit Rs.50,000 During Account Setup For a Premium Visa Signature Debit Card With All the Premium Benefits. Else, you can deposit just ₹5000 for 0 balance savings account which you can take it back.

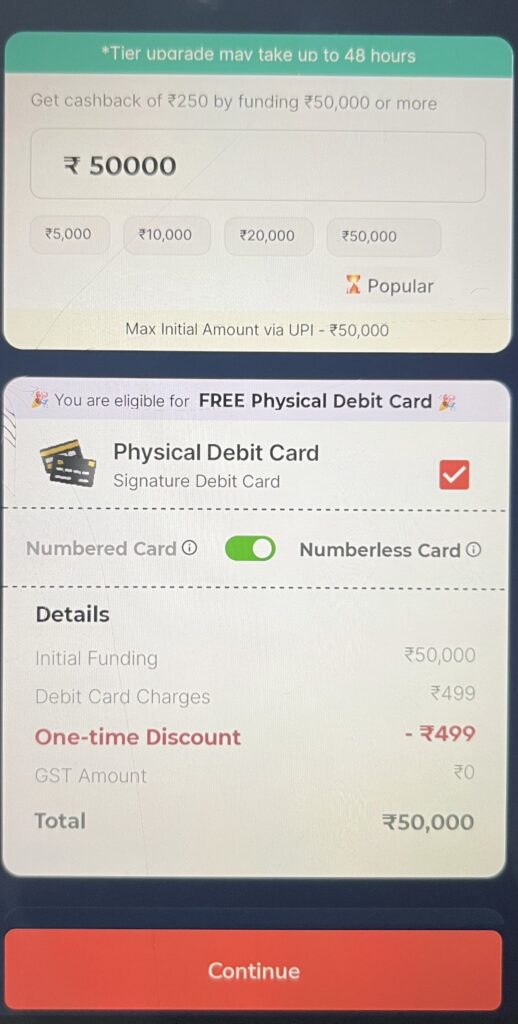

10. Enter the amount to deposit, Select Numbered or Numberless card and transfer fund from your primary bank account via any UPI app.

- Megastar Tier gets Free Debit card and other tier has to pay card charges. You can upgrade Tier later based on eligibility on the Indie App.

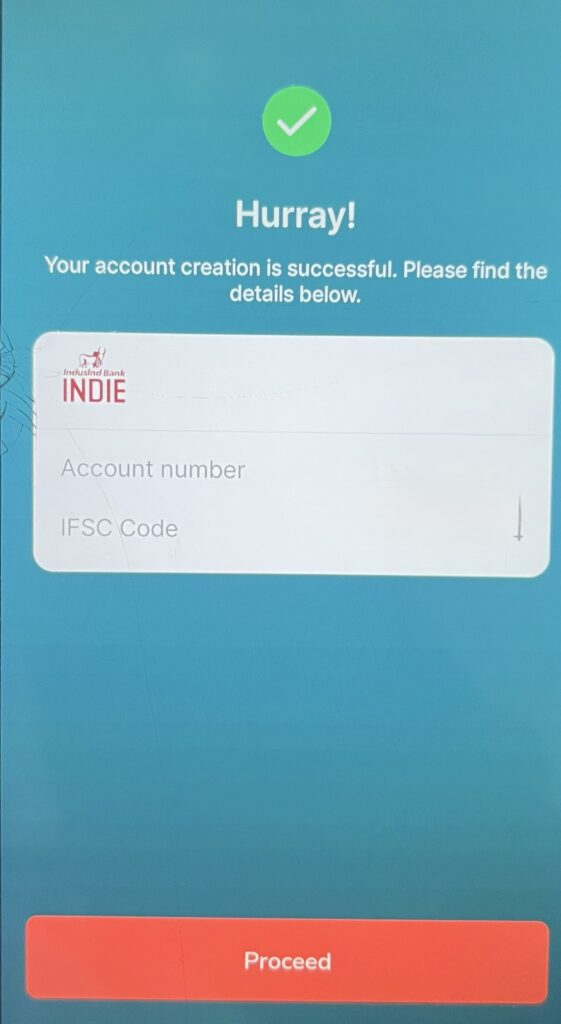

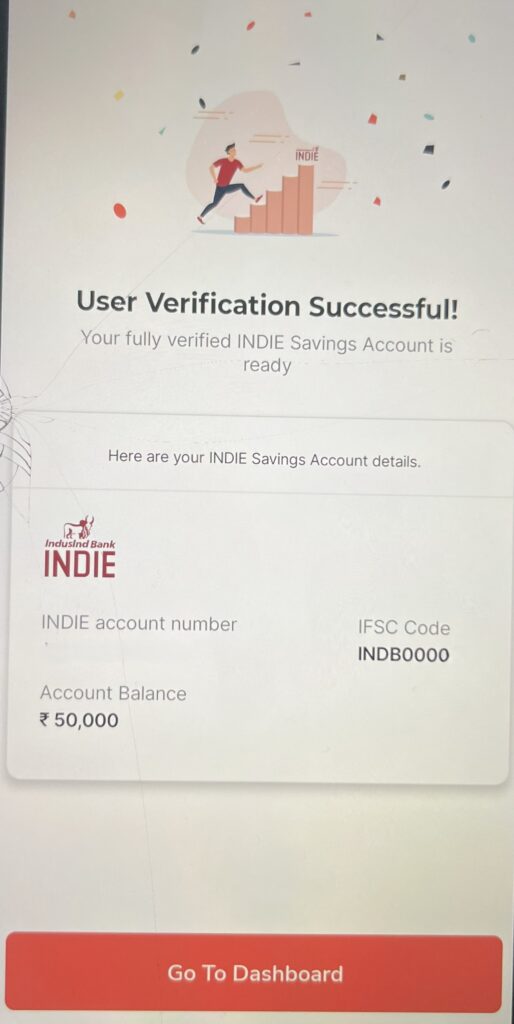

11. Once you transfer initial fund to new IndusInd bank Indie account, your saving account will be opened instantly.

- Good thing with IndusInd bank is your Account number will be your phone number

12. if you are new customer to IndusInd bank, please complete the KYC on app.

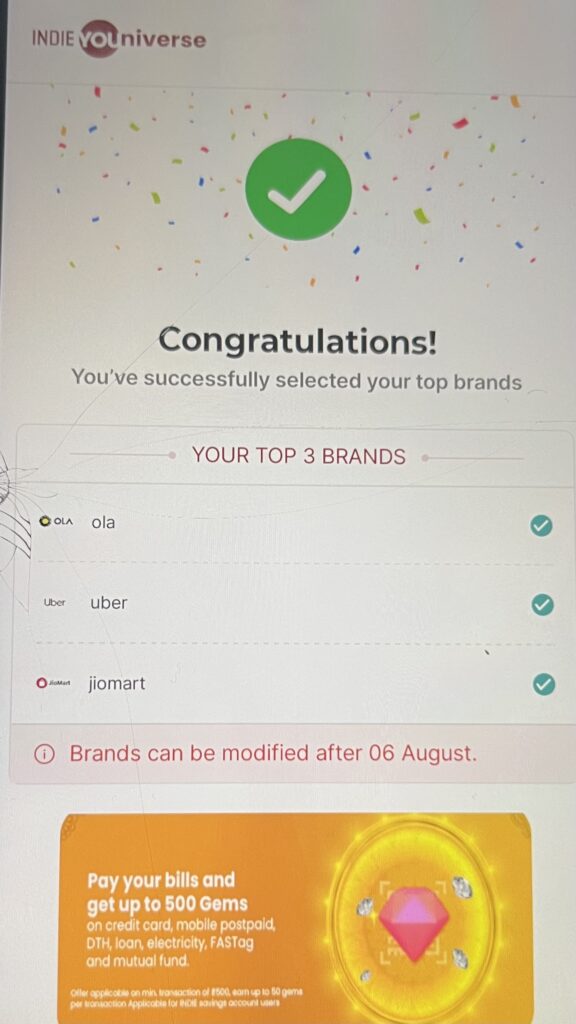

13. Once account is opened, you can select Top 3 Brands out of 10+ brands to get 3% Gems.

- 1 Gem = ₹1

14. Pay bills using Indie Savings account on Indie App and get Cashback – 50 Gems on Rs.500 or more on eligible categories (max. 500 Gems per calendar month)

- Bill payments Eligible categories: Credit Card, FASTag, DTH, Loan Repayment, Electricity, Mobile Postpaid & Mutual Fund.

15. Done !! Enjoy Your Savings account with the best Interest rate.

Comparison between Megastar, SuperStar and Star

| Star | SuperStar | MegaStar | |

Minimum balance Requirement | 0 | ₹25,000 or more in SA OR ₹1,00,000 or more in SA+FD+MF OR First salary credit of Rs. 25,000 or more. | ₹50,000 or more in SA OR ₹2,00,000 or more in SA+FD+MF OR First salary credits of Rs 50,000 or more. |

INDIE GEMS Required to upgrade to next Tier | NA | NA | 1500 |

| Debit Card Type | Visa Platinum | Visa Platinum | Visa Signature |

| Forex Mark-up | 2% | 2% | 0% |

| Gems on select brands | 1% | 2% | 3% |

| GEMs on other brands | 0.25% | 0.25% | 0.5% |

| Gems on fuel | 0% | 2% (Max 500/Month) | 3% (Max 500/Month) |

| Domestic Airport Lounge Access | NA | NA | Once per Quarter |

| Complimentary Tickets on Bookmyshow | NA | BOGO up to ₹250 | BOGO up to ₹400 |

| Bill Payments | 25 Gems on bill payment of Rs.500 or more (max. 200 Gems/month) | 25 Gems on bill payment of Rs.500 or more (max. 200 Gems/month) | 50 Gems on bill payment of Rs.500 or more (max. 500 Gems/month) |

Redemption limit on INDIE Gems | 1,500 per day; 2,500 in a month. | 1,500 per day; 2,500 in a month | 1,500 per day; 2,500 in a month |

| Charges for Non Maintenance of Funds | NA | 10% of the balance shortfall subject to a maximum of Rs 900 per quarter. | NA |

Need More Details? If you still have any doubts about this offer or need more information, Just comment below and we’ll surely help you.

Don’t forget to share this article on WhatsApp, Facebook, LinkedIn and Twitter