Kotak811 Super Account

Table of Contents

How to open Kotak811 Super Savings Account – 5% Cashback

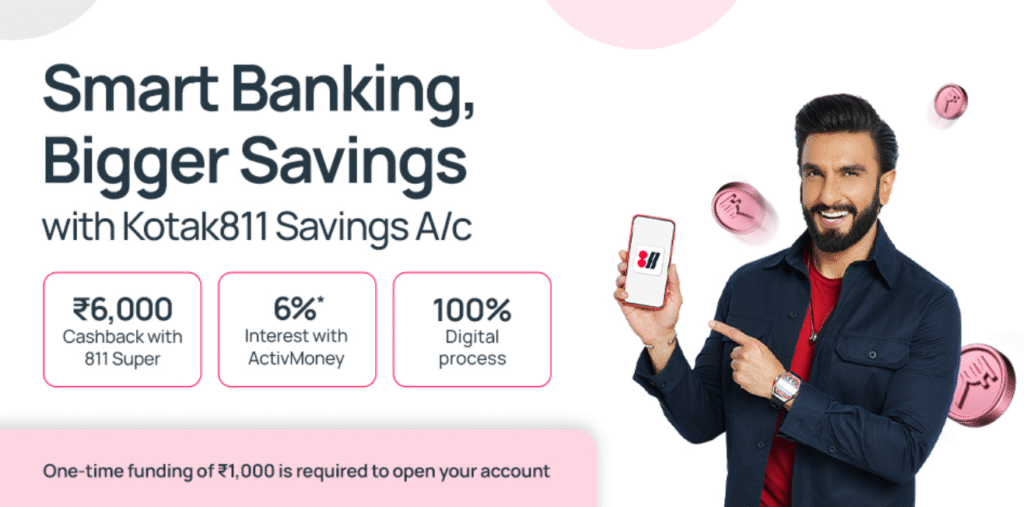

Kotak811 Super Savings Account, Kotak Mahindra Bank Savings Account, Kotak811 Interest rate, How to Open Kotak 811 Account Online – Hello friends, Today we are going to provide you with all the details to open Kotak811 Zero Balance Savings Account Online, you can open an account in just 5 Minutes. We recently posted how to open IndusInd Bank Savings Account & hope you guys are already utilized.

Kotak 811 is a zero-balance digital bank account available to everyone. It lets you choose between a zero balance account or an 811 Super savings account based on your needs, which acts as a one-stop solution for all your financial needs and day-to-day transactions. The Kotak 811 Super account helps you save 5% cashback on your debit card spends.

Kotak 811 Savings Account vs Kotak 811 Super Savings Account Benefits

| Benefits | Kotak 811 | Kotak 811 Super |

| Account Type | Basic – Zero Balance | Premium – ₹5,000 Monthly Deposit |

| Interest | 2.5–3.5% p.a. on savings | Same (ActivMoney sweep applies) |

| Cashback | None | 5% (max ₹500/month) on debit spends |

| Debit card | Free Virtual card Visa Classic Physical – ₹399 | Free Visa Platinum card |

| Maintenance charges | Free | ₹399 + GST – Annually |

| ATM/cash limits | Withdraw ₹25k; deposit ₹10k or 1 txn | Withdraw ₹100k; deposit ₹200k or 4 txns |

| Min. Monthly Deposit | None | ₹5,000 |

| Insurance coverage | ₹2 L PA, ₹50k purchase protection | ₹15 L PA, ₹50 L air, ₹1 L baggage & purchase |

| Customer Supper | Standard | “Super” Support |

What do You need to Create a Kotak811 Bank Account?

- Aadhaar Card

- Original PAN Card

- A White Sheet of Paper and a Black Pen

- Uninterrupted Data Connectivity

- Your Smart Phone

- A well-Lit Room

- A Plain Wall Behind

- Also, Read: Get a Lifetime Free ICICI Bank Credit Card

How to open Kotak811 Super Savings Account

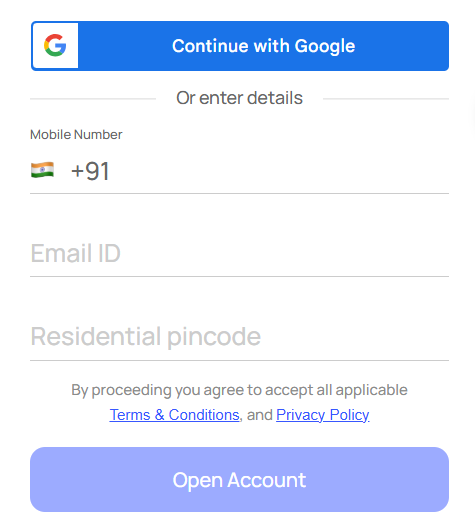

1. First of all, Visit the Kotak811 Account opening page from the below button

2. Now Enter your mobile number, email address and your city Pin code

3. Click on the Open Account and Validate your mobile number with OTP

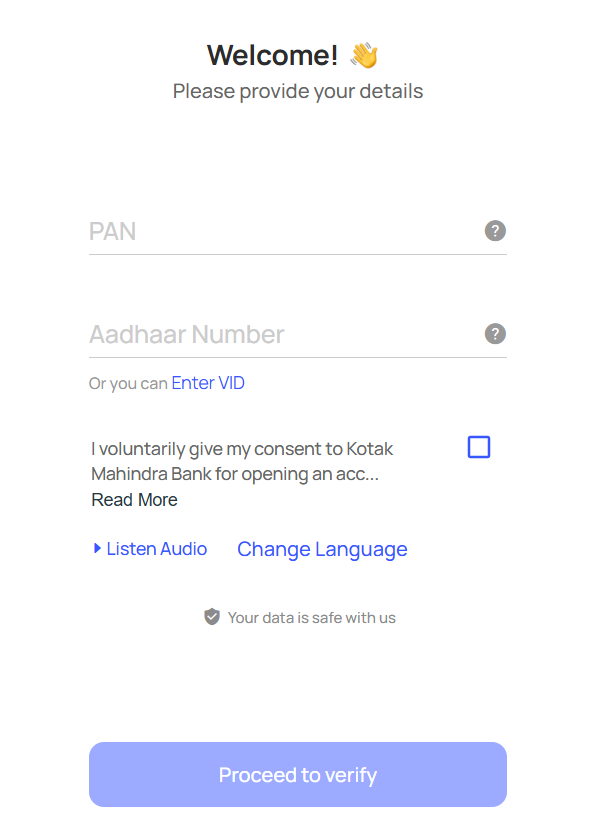

4. Now enter your PAN Card number and Aadhaar card number.

5. Click on the Proceed to verify and validate your Aadhaar with OTP

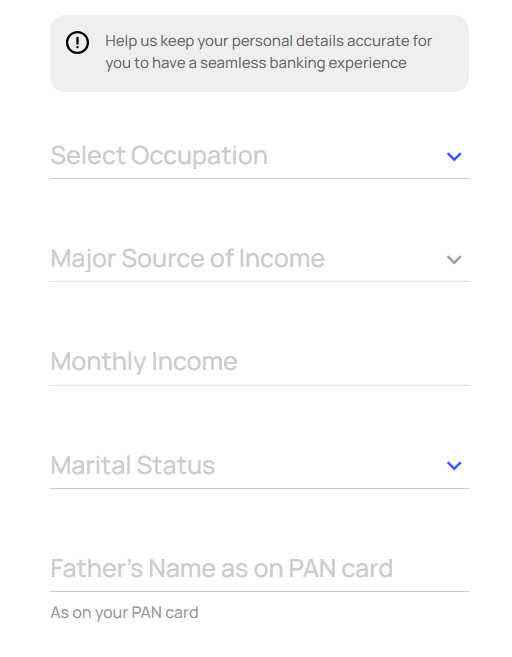

6. Select your occupation, Monthly income, Marital status and Father’s name

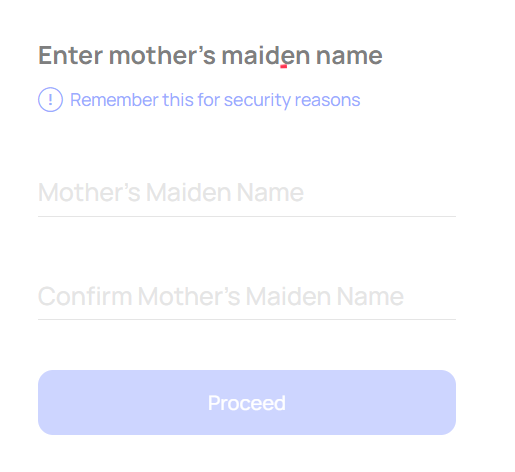

7. Now enter your Mother’s name and click on Proceed button

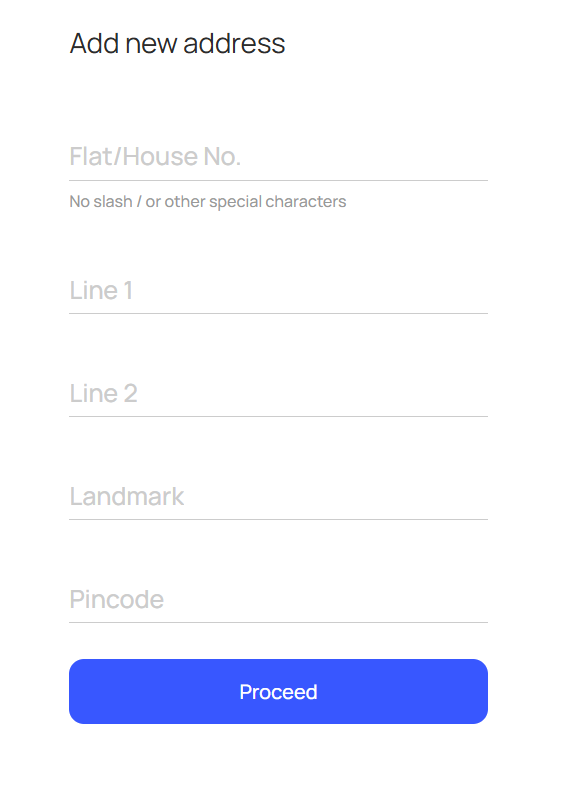

8. Select your Aadhaar address or enter your latest current address where you want your card to be delivered and click on Proceed.

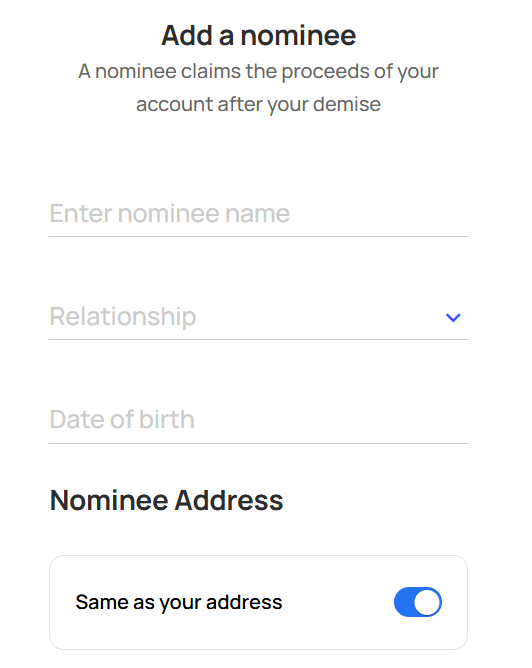

9. Now add a Nominee details like Name, Relationship, Date of Birth and Nominee Address.

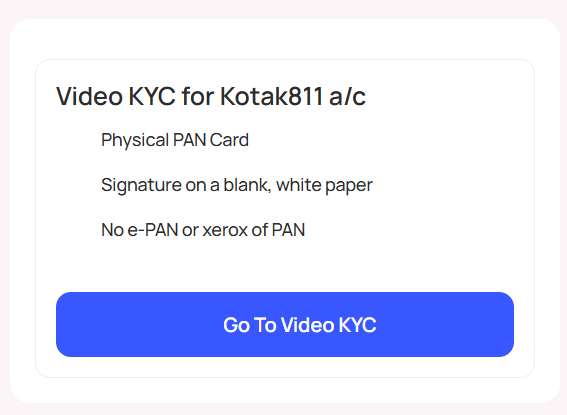

10. Now complete the Video KYC with original PAN card and Paper & Pen.

11. Click on Go To Video KYC and Read & give your consent and click on Agree & Proceed.

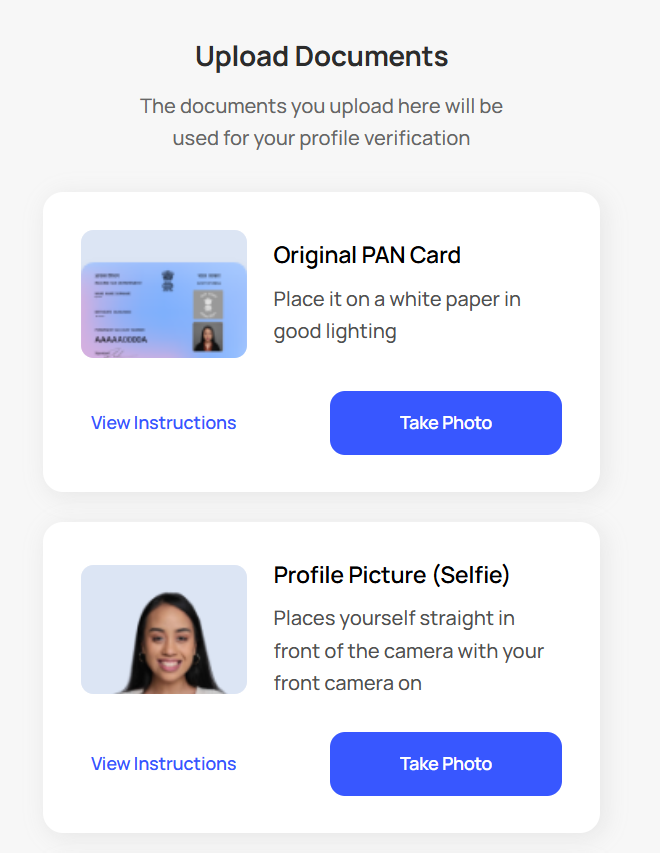

12. Now upload your documents like Original PAN card, Selfie and Signature.

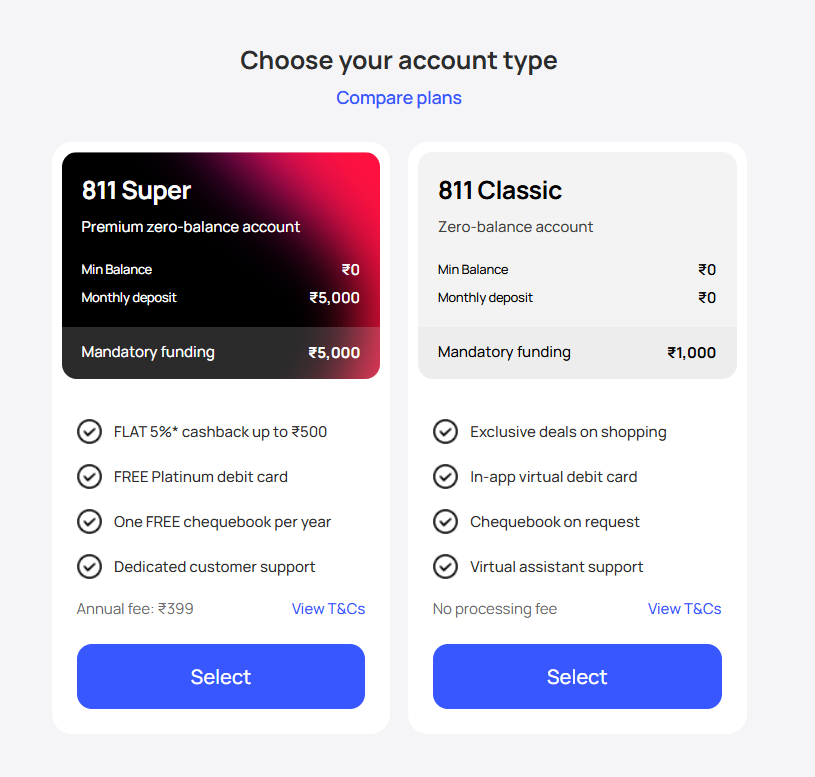

13. Now choose your Account type as 811 Super or 811 Classic.

- Note: If you want premium benefits, go for 811 Super with ₹399+GST annual charges, You will get FREE Platinum debit card and Flat 5% Cashback on DB spends up to ₹500 per month. But you have to deposit ₹5,000 every month which you can withdraw anytime later.

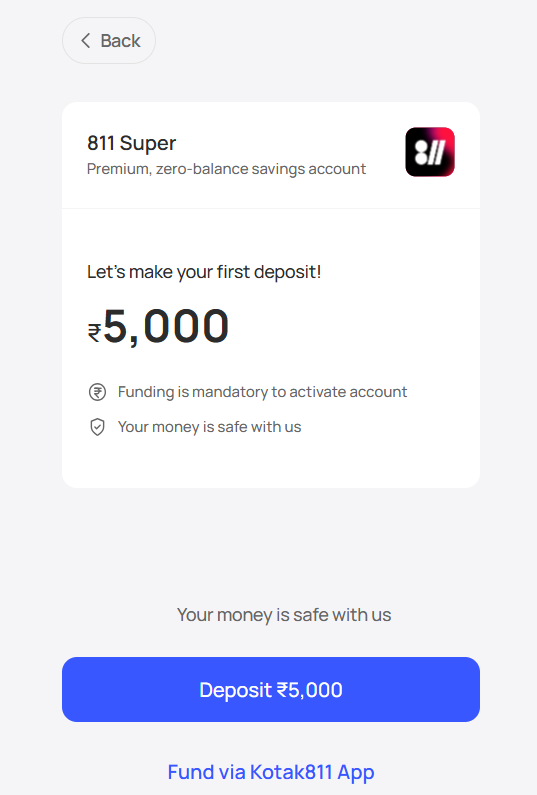

14. Next step click on Deposit button to fund initial amount to your account. Complete the amount transfer via any UPI app.

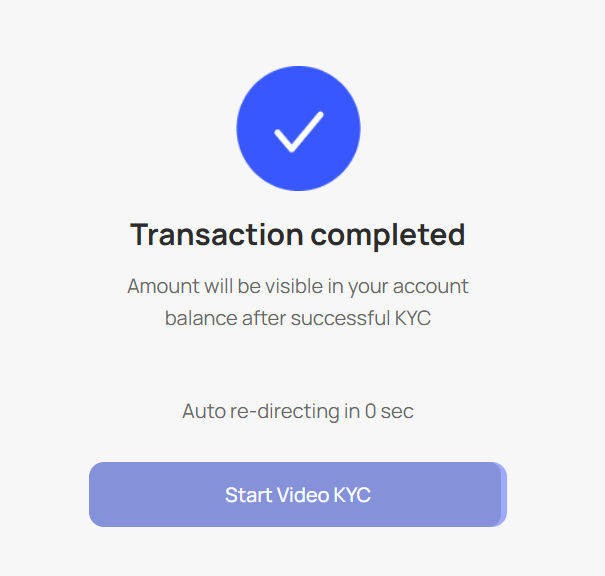

15. Now it will redirect you to Video KYC. complete the Video KYC right away. If you delay or planning to take later, it will convert to physical KYC and agent will call you for KYC completion.

16. It may take from 8 hours up to a day to complete your KYC verification.

17. Install the Kotak Bank App from Play Store to access your Savings Account.

18. Done !! Enjoy…

Need More Details? If you still have any doubts about this offer or need more information, Just comment below and we’ll surely help you.

Don’t forget to share this article on WhatsApp, Facebook, Instagram, and Twitter