IDFC First Bank Lifetime Free Credit Card

Table of Contents

Apply and Get Lifetime Free IDFC First Bank Credit Card – No Annual and Joining Fees

First Millennia Credit Card, First Select Credit Card, idfc first bank credit card apply online, IDFC First Credit Card – Hello Folks, Hope you guys are enjoying Lifetime Free Credit Card Offers. We regularly post Free Credit Card Offers and How to Check Free Credit Score Articles so that you can enjoy Free Limit and Many Offers & Reward Points on your Spends with Free Credit Card. We also published OneCard Lifetime Free Credit Card to get Free Metal Credit Card. Here we are back with another Lifetime Free Credit Card from IDFC First Bank

IDFC First Bank Offers four Lifetime-Free Credit Cards catering to the varied needs of the users. These cards come with the unique feature of dynamic interest rates, based on the user profile, IDFC First Bank Credit Cards are offered in 4 different variants. Those are First Classic, First Select, First Wealth, and First Millennia

IDFC Lifetime Free Credit Card Features

- Lifetime Free Credit Card, Zero fees

- Interest-Free Cash Withdrawal from ATM (Up to 48 days)

- 3x Rewards on all the retail store spends

- 6x Rewards on online transactions

- 10x Rewards on incremental spending above ₹20,000

- Reward points that never expire

- No Income Proof is Required

- Welcome Gift Voucher Worth ₹500 on spending ₹15,000 in the first 3 months

- 25% Off on Movie Tickets once a month up to ₹100

- Up to 20% Offer across 1500 Restaurants

- 5% Cashback on spend value of first EMI transaction done within 90 days

- Personal Accident Insurance cover of ₹2,00,000 (Min. 1 Transaction Last Month)

- 50+ In-App Discounts on many Brands

- Also, Read: Onecard Lifetime Free Metal Card

How to Apply and Get IDFC First Bank Lifetime Free Credit Card

1. First of all, Visit the IDFC First Bank Credit Card Page from the Below Link

2. Now you will redirect to the IDFC Credit Card Signup Page

3. Your Age Should be 27 (Self Employed) or 25 (Salaried)

4. Tap on the Get OTP Button and Verify your Mobile Number with OTP

5. Then Read and Accept the Terms and Tap on Proceed button

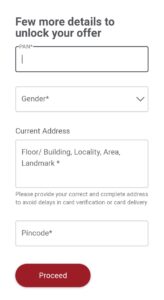

6. Now Enter a Few More Details Like PAN Number, Gender, Address and Pin Code

Note: Must Enter The City Pincode or Else you will not be Eligible to Get Credit Card

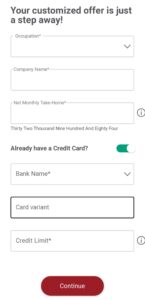

7. Now Enter your Occupation, Company Name and Monthly Salary & Enable & Select your Existing Credit Card and Credit Limit

Note: Must Enter your Salary as ₹30,000 or Above & You must have an Existing Credit Card

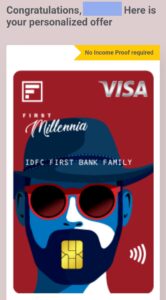

8. Now you will get a Congratulations Message on the Screen and your Personalized Credit Card. No Income Proof Required

9. Scroll down and you will see your Credit Limit. So Tap on the Get your Card button

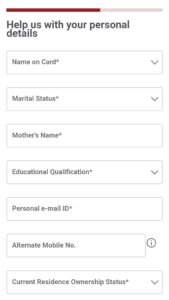

10. Now Enter your few other Personal details Like Name, Email, Alternate Mobile Number, Marital Status, Mother’s Name, Educational Qualification and Other Asked Details

11. Now Enter your office Address and Pincode details & Tap on Proceed

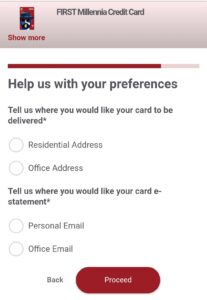

12. Now Select where your card is to be Delivered and Email to get e-statements

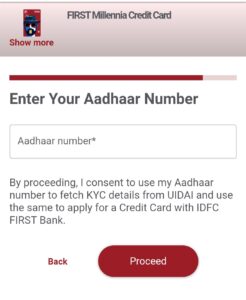

13. Now Enter your Aadhaar Card Number and Proceed to Verify it with OTP

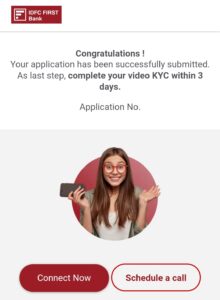

14. Tap on Submit and you will see Success Message on the Screen and you will also get Confirmation SMS

15. Your application has been successfully submitted. Now Complete your Video KYC within 3 Days. You can also schedule your available time to complete the KYC

16. Once It is Completed and Verified. Your card will be processed and delivered to your Address

17. Done !! Enjoy…

Need More Details? If you still have any doubts about this offer or need more information, Just comment below and we’ll surely help you.

Don’t forget to share this article on WhatsApp, Facebook, Instagram, and Twitter